Imagine you have ₹1 crore to invest. Your wealth advisor tells you: “Put it in a mutual fund for safe, diversified growth.” “Try a PMS for a customized strategy.” “Or,...

Read MoreAt Ashvvy, we make sure your years of service translate into lifelong financial security.

A government job brings stability, but stability doesn’t always mean simplicity.

Your financial journey is very different from private-sector professionals, and that’s why your planning needs to match your career structure:

ASHVVY offers a specialized advisory practice focused entirely on the unique financial ecosystem of government employees, guided by an expert who understands the public sector’s need for trust and accountability.

Our practice is led by Deepak Jain, Managing Director at ASHVVY and a former government employee himself. His guidance ensures the investment management for government officials is customized to their unique needs.

We help you go beyond basic savings to secure the retirement lifestyle you want. From NPS optimization to integrating all benefits, we map out your full retirement income.

Your Gratuity, GPF, and LTC are more than just perks; they can become growth opportunities. We guide you on putting these to work so they support the life you want after service.

You’re not alone in this journey. Hundreds of Judges, Teachers, and Police Officers have trusted our advice. You gain from strategies proven to work for your peers, tailored to your profession & real-world needs.

Mr. Deepak Jain founded Ashvvy Investment in 2000 after spending 15 years as a government employee in a customer-facing public service role. The trust and credibility he built during this time led many government professionals to rely on him for their wealth management needs.

Over the years, he has grown Ashvvy Investment from inception to managing over ₹300 crore in assets, with several clients continuing their association since day one. Having worked within the government system himself, Mr. Jain deeply understands the financial structure, benefits, and long-term planning needs of government employees.

This insight led to the creation of Ashvvy’s Special Practice for Government Employees, enabling professionals across the country to plan their wealth with clarity, confidence, and continuity.

Imagine you have ₹1 crore to invest. Your wealth advisor tells you: “Put it in a mutual fund for safe, diversified growth.” “Try a PMS for a customized strategy.” “Or,...

Read MoreSIP or Systematic Investment plans have caught up as a household name. Most people today choose a digital platform of choice and invest in monthly SIPs. While there is nothing...

Read MoreAchieving financial independence has become a necessity, and investing strategically has become a fundamental part of modern life. According to the NSDL and CDSL data, 2024 saw a 33% increase...

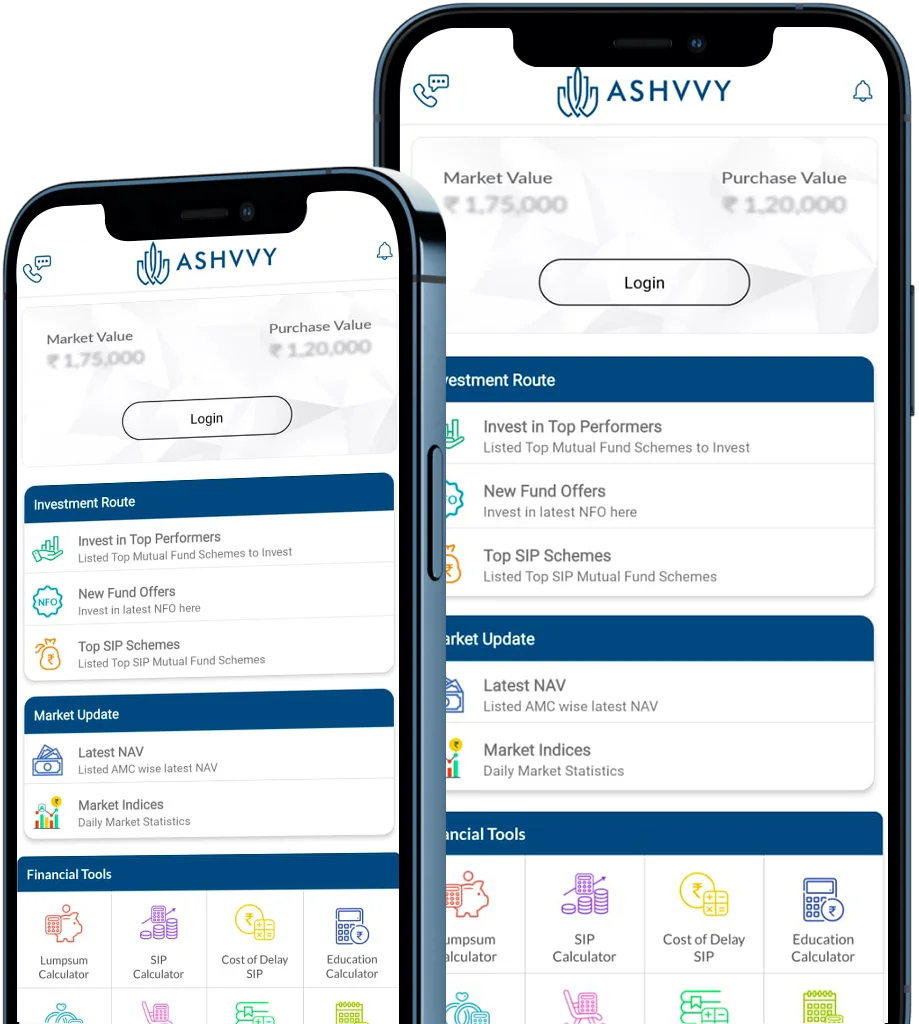

Read MoreMarkets move, so do we.

Bringing you the fastest dose of financial news, market updates, and one-of-a-kind tools, so you have the first mover advantage, the Ashvvy Advantage.

3000+ people are growing their wealth with us, are you next?

3000+ people are growing their wealth with us, are you next?

ABOUT US

HELP

AMFI Registered Mutual Fund Distributor | ARN- 172057 | Initial Date of Registration: 28/8/2020 | Current Validity: 27/8/2026

Grievance Officer: Rishika Jain | 9643879317

Copyright © 2025 Ashvvy Investment. All rights reserved.