For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreFixed income products help you earn a regular income while preserving capital through market ups and downs.

Fixed income products are financial instruments that pay investors a fixed rate of return over a specific period.

In simple terms, you lend your money to a company, bank, or government — and in return, receive regular interest payments along with the principal at maturity.

These investments are ideal for those who want to:

– Earn a steady income

– Preserve capital

– Balance the risk of equity exposure in their portfolio.

When you invest in a fixed-income instrument, you’re essentially lending money to a government, company, or institution.

In return, the issuer promises to pay you interest at a fixed rate for a specific period and return your principal amount upon maturity.

Interest is paid at fixed intervals.

Especially in government or high-rated instruments.

Your money is invested for a set period.

Returs are not tied to daily market movements.

Fixed income products come in different forms, each offering a balance between safety, liquidity, and returns.

Here are the most common types you can explore:

Corporate FDs are similar to bank FDs but are issued by companies or Non-Banking Financial Companies (NBFCs). They offer higher interest rates than bank deposits to attract investors, though they carry slightly more risk. Well-rated corporate FDs from reputed companies can offer a good balance between returns and reliability.

Bank Fixed Deposit | Corporate Fixed Deposit | |

Return Range | 3-5% | 5-7% |

Risk | Low risk | High Risk |

Liquidity & Withdrawal | Usually allows premature withdrawal with a small penalty. | Premature withdrawal is often restricted or may attract higher penalties. |

Tenure | 7 days to 10 years | 1 to 5 years |

NCDs are fixed-income instruments issued by companies to raise capital. They pay a fixed rate of interest over a defined period and cannot be converted into equity shares.

Many NCDs are listed on stock exchanges, allowing investors to buy or sell them before maturity. They generally offer higher returns than bank deposits but come with credit risk, so it’s crucial to verify the issuer’s rating.

Bonds are among the most popular fixed-income instruments. When you buy a bond, you’re lending money to a government or company in return for fixed interest payments and your capital back at maturity.

Types of Bonds:

– Government Bonds (G-Secs): Backed by the government, ideal for risk-averse investors.

– Corporate Bonds: Offer higher yields, depending on the issuer’s rating.

– Tax-Free Bonds: Interest earned is exempt from tax, issued by government-backed institutions like NHAI, REC, and PFC.

– PSU Bonds: Issued by public sector companies; they offer a balance of safety and better returns.

Debt mutual funds pool investor money and invest in bonds, government securities, and money market instruments.

They provide liquidity, diversification, and professional management, making them a good choice for investors who want fixed income exposure without directly buying bonds or FDs.

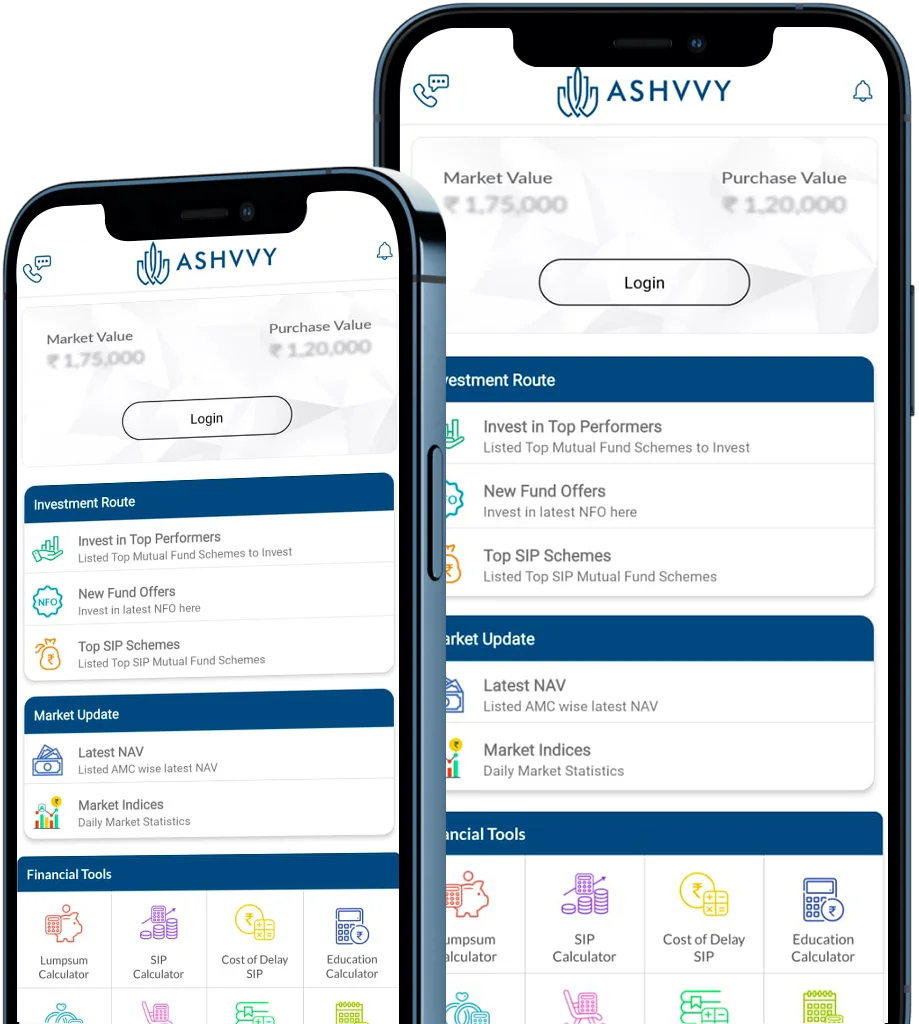

At Ashvvy, we make fixed income investing simple, transparent, and effective. Our platform curates top-quality investment options, including corporate FDs, bonds, NCDs, and government securities, aligned with your risk profile and financial objectives.

With expert guidance, verified issuers, and an easy investment process, we help you build a stable portfolio that offers steady returns and capital safety.

For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreImagine you have ₹1 crore to invest. Your wealth advisor tells you: “Put it in a mutual fund for safe, diversified growth.” “Try a PMS for a customized strategy.” “Or,...

Read MoreSIP or Systematic Investment plans have caught up as a household name. Most people today choose a digital platform of choice and invest in monthly SIPs. While there is nothing...

Read MoreMarkets move, so do we.

Bringing you the fastest dose of financial news, market updates, and one-of-a-kind tools, so you have the first mover advantage, the Ashvvy Advantage.

3000+ people are growing their wealth with us, are you next?

3000+ people are growing their wealth with us, are you next?

ABOUT US

HELP

AMFI Registered Mutual Fund Distributor | ARN- 172057 | Initial Date of Registration: 28/8/2020 | Current Validity: 27/8/2026

Grievance Officer: Rishika Jain | 9643879317

Copyright © 2025 Ashvvy Investment. All rights reserved.