For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreAshvvy ensures you get insurance that’s transparent, right-sized, and built around your goals.

Offers financial protection to your family in case of your untimely demise. It can also act as a long-term savings and investment tool, depending on the plan chosen.

Popular types include:

- Term Insurance: Pure protection plan with high cover and low premiums.

- Endowment Plan: Combines life cover with savings.

- ULIPs: Market-linked plans that offer both insurance and investment.

- Whole Life Policy: Provides lifelong coverage with maturity benefits.

Covers medical expenses arising from illness, surgery, or hospitalization. With rising healthcare costs, a good health plan ensures quality treatment without financial stress.

Common types include:

- Individual Health Plan

- Family Floater Plan

- Senior Citizen Health Plan

- Critical Illness Plan

General insurance protects your valuable assets, like your health, home, vehicle, or business, from unexpected financial losses.

Common types include:

- Motor Insurance: Protects your car or bike against accidents, theft, and third-party liabilities.

- Home Insurance: Secures your property from damage caused by fire, natural disasters, or theft.

- Travel Insurance: Offers financial protection against trip cancellations, lost baggage, or medical emergencies abroad.

There’s no shortage of insurance products today, but not all of them will actually protect you when you need them.

A single missed clause, a hidden co-payment, or a small sub-limit buried in a long policy document can leave you paying out of pocket despite having a policy.

That’s why choosing the right insurance matters far more than simply buying one.

At Ashvvy, we help you cut through the complexity:

We assess your financial goals, dependents, and current coverage to identify what protection you truly need.

Our experts analyze plans across trusted insurance providers for the best balance of premium, coverage, and flexibility.

We decode co-payments, sub-limits, waiting periods, and exclusions — so you know exactly what you’re signing up for.

From policy selection to claim support, our advisors stay by your side, ensuring a smooth and transparent experience.

For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreImagine you have ₹1 crore to invest. Your wealth advisor tells you: “Put it in a mutual fund for safe, diversified growth.” “Try a PMS for a customized strategy.” “Or,...

Read MoreSIP or Systematic Investment plans have caught up as a household name. Most people today choose a digital platform of choice and invest in monthly SIPs. While there is nothing...

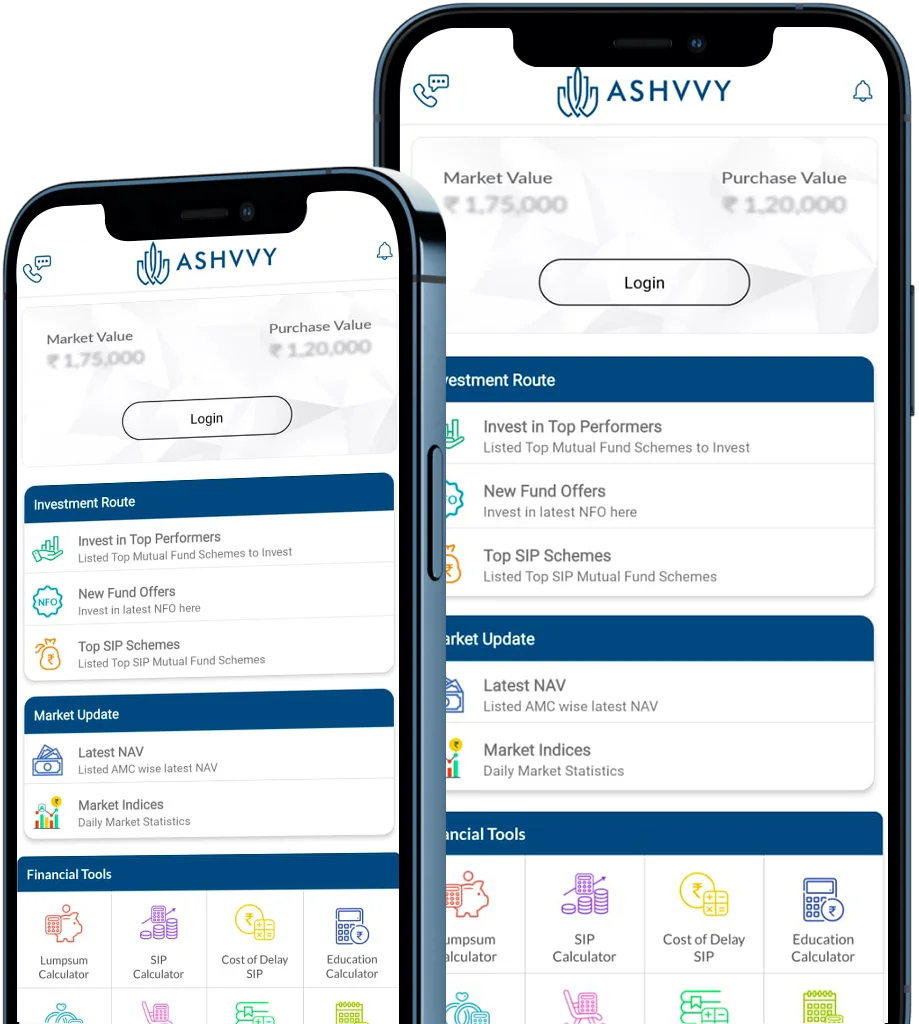

Read MoreMarkets move, so do we.

Bringing you the fastest dose of financial news, market updates, and one-of-a-kind tools, so you have the first mover advantage, the Ashvvy Advantage.

3000+ people are growing their wealth with us, are you next?

3000+ people are growing their wealth with us, are you next?

ABOUT US

HELP

AMFI Registered Mutual Fund Distributor | ARN- 172057 | Initial Date of Registration: 28/8/2020 | Current Validity: 27/8/2026

Grievance Officer: Rishika Jain | 9643879317

Copyright © 2025 Ashvvy Investment. All rights reserved.