For many NRIs, money earned abroad often comes with one big question: where should it grow? While global markets offer multiple opportunities, India continues to stand out as a long-term...

Read MoreAt Ashvvy, our women‑focused investment practice empowers you to master your finances, create wealth, and build a secure future.

Too often, women are told: “Let the men handle money,” or “You won’t understand this,” or “Don’t worry about it.” Finances are treated like a complicated world reserved for someone else. But here’s the truth: women already manage money every day — from budgeting household expenses to planning for their family’s needs, all while balancing their own goals.

It’s not about learning something new; it’s about owning what you already do exceptionally well. Your natural skills, like saving, planning, negotiating, and prioritizing, make you one of the most capable investors.

In fact, women are investing with remarkable commitment: their average SIP contributions are 22% higher than men’s, while their lump sum investments are 45% more. What stands out even further is that 72% of these women investors come from smaller cities (B30), showing that mutual fund investing is no longer just a big‑city trend.

Your financial journey is unique, and it deserves care, understanding, and the right guidance. At Ashvvy, our women-focused investment practice is built to support your real life, your real goals, and your real challenges with a plan that fits you.

Here’s how we support you at every step:

Mrs. Banita Jain, Co-Founder and Director at Ashvvy Investment, has been a strong voice for women in finance for over two decades. Her insights on women taking charge of their financial lives have been featured across local publications as well as national platforms.

She has spoken at women-led panels, received multiple awards recognising women achievers in finance, and has guided hundreds of women towards financial awareness and independence. This conviction led to the creation of Ashvvy’s Special Practice for Women, a dedicated segment focused on empowering women to confidently manage, grow, and own their financial journeys.

Mrs. Jain firmly believes that financial independence is fundamental to women’s welfare and to a more balanced society.

For many NRIs, money earned abroad often comes with one big question: where should it grow? While global markets offer multiple opportunities, India continues to stand out as a long-term...

Read MoreTravel helps you relax, recharge, and spend quality time with family and friends. However, when vacations are planned without proper financial planning, they can create stress later in the form...

Read MoreFor many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

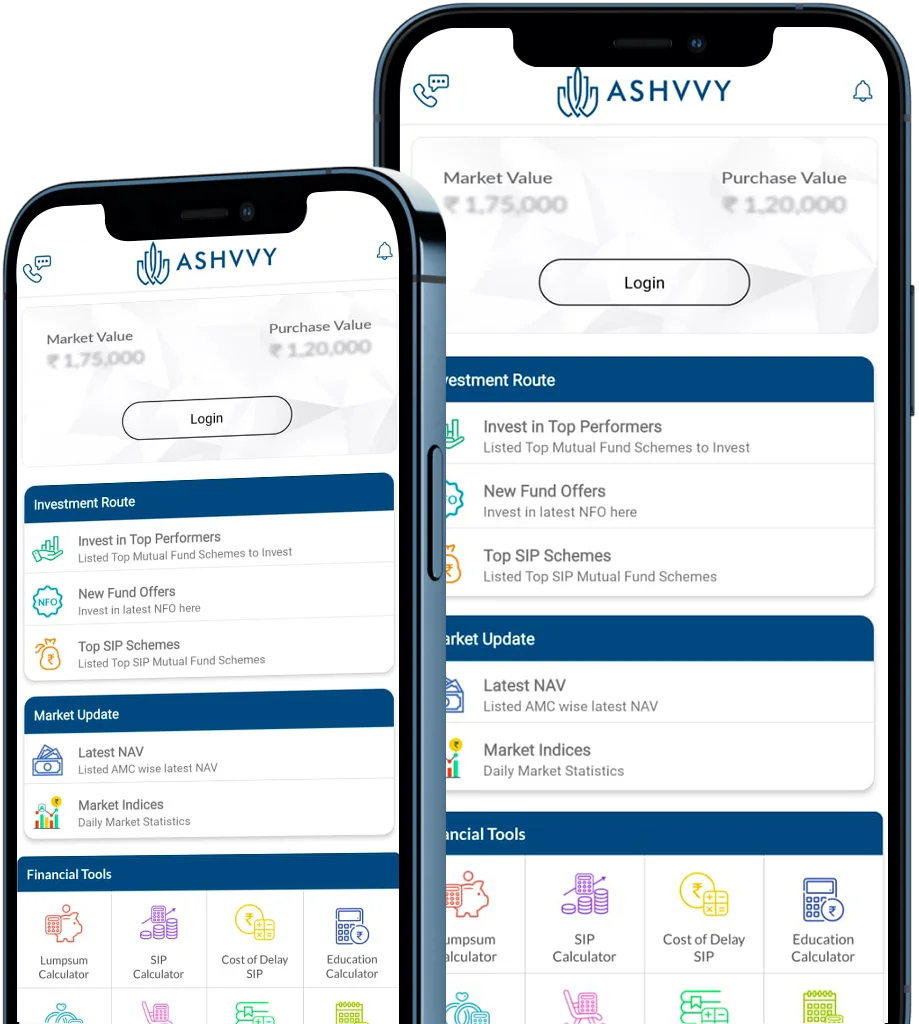

Read MoreMarkets move, so do we.

Bringing you the fastest dose of financial news, market updates, and one-of-a-kind tools, so you have the first mover advantage, the Ashvvy Advantage.

3000+ people are growing their wealth with us, are you next?

3000+ people are growing their wealth with us, are you next?

ABOUT US

HELP

AMFI Registered Mutual Fund Distributor | ARN- 172057 | Initial Date of Registration: 28/8/2020 | Current Validity: 27/8/2026

Grievance Officer: Rishika Jain | 9643879317

Copyright © 2025 Ashvvy Investment. All rights reserved.