For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreAt Ashvvy, we help you invest in quality businesses built for long-term success.

Equity (stocks) is one of the most powerful tools for long-term wealth creation. When used strategically, equity investing helps:

– Diversify your overall investment portfolio

– Reduce concentration risk

– Capture India’s long-term economic growth potential

– Generate inflation-beating returns through compounding

At ASHVVY Investment Private Limited, we help you create a disciplined equity portfolio that aligns with your risk profile, goals, and investment horizon, so your wealth grows steadily and sustainably over time.

In partnership with Motilal Oswal, we bring research-backed stock insights and personalized advisory to help you invest confidently and grow wealth the right way.

With Motilal Oswal’s award-winning research foundation and ASHVVY’s advisory expertise, every recommendation is built on data, sector analysis, and strong fundamentals.

Get clear, step-by-step guidance and access to a real equity expert who discusses options with you before any investment decision.

We recommend equity exposure based on your goals, risk appetite, and investment horizon, ensuring a strategy that evolves with your financial journey.

We combine equity growth with risk-balanced asset allocation to support stable long-term wealth creation.

Equity investing is ideal if you:

– Have a higher risk appetite and can handle short-term volatility without panic-selling.

– Possess a basic to medium understanding of financial markets.

– Already have a stable foundation through mutual funds, fixed income products, or other long-term wealth tools, and now want to aim for higher returns.

– Believe in India’s expanding economy and business opportunities.

For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreImagine you have ₹1 crore to invest. Your wealth advisor tells you: “Put it in a mutual fund for safe, diversified growth.” “Try a PMS for a customized strategy.” “Or,...

Read MoreSIP or Systematic Investment plans have caught up as a household name. Most people today choose a digital platform of choice and invest in monthly SIPs. While there is nothing...

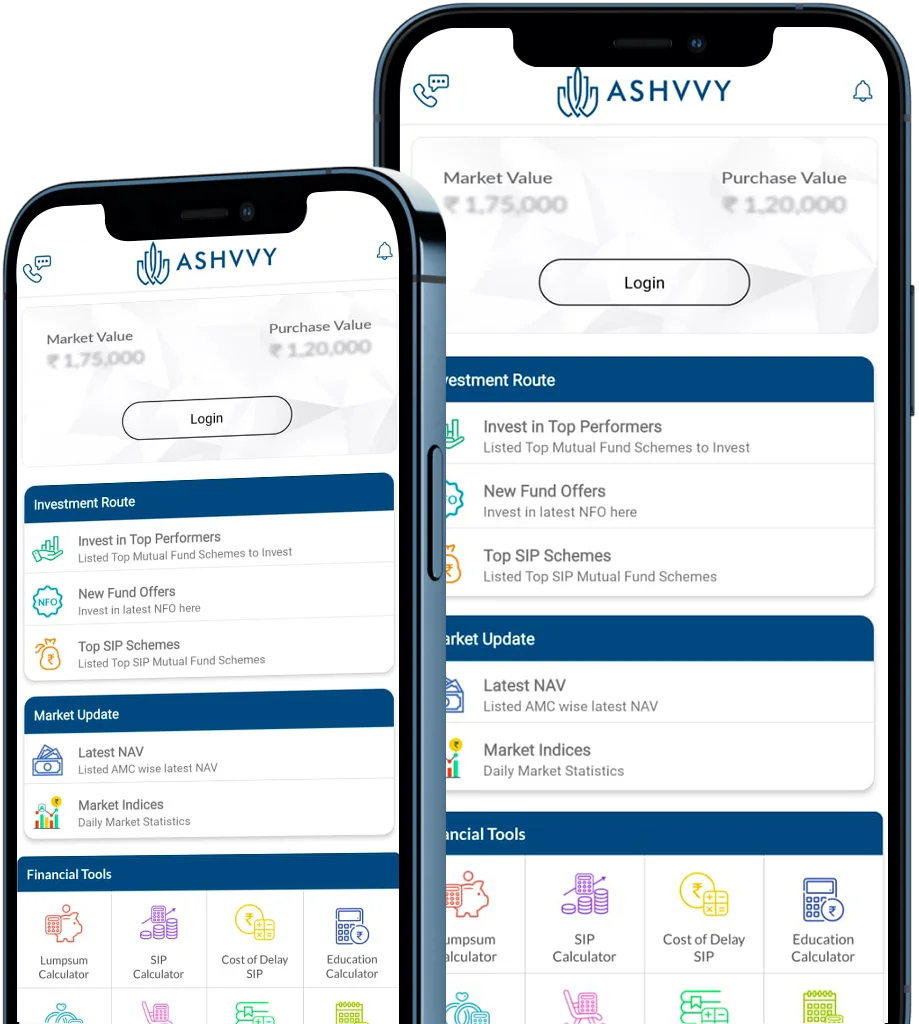

Read MoreMarkets move, so do we.

Bringing you the fastest dose of financial news, market updates, and one-of-a-kind tools, so you have the first mover advantage, the Ashvvy Advantage.

3000+ people are growing their wealth with us, are you next?

3000+ people are growing their wealth with us, are you next?

ABOUT US

HELP

AMFI Registered Mutual Fund Distributor | ARN- 172057 | Initial Date of Registration: 28/8/2020 | Current Validity: 27/8/2026

Grievance Officer: Rishika Jain | 9643879317

Copyright © 2025 Ashvvy Investment. All rights reserved.