For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MorePMS & SIF bring the edge of expert management and

tailored investment strategies to your portfolio.

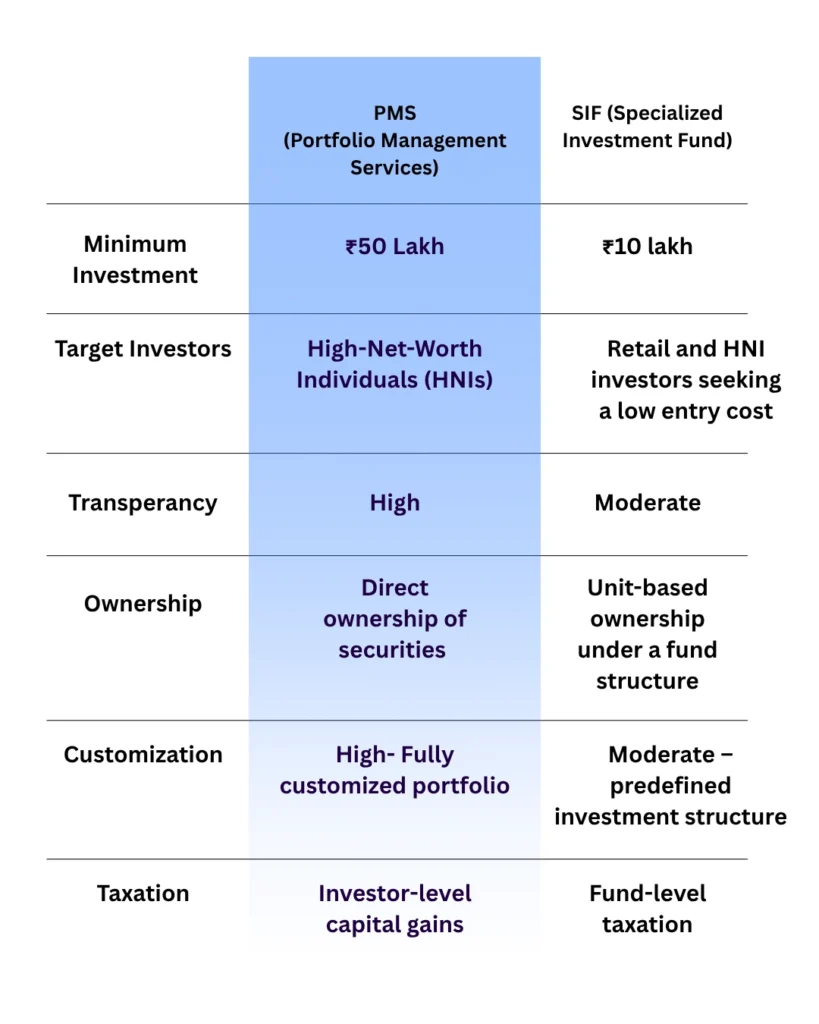

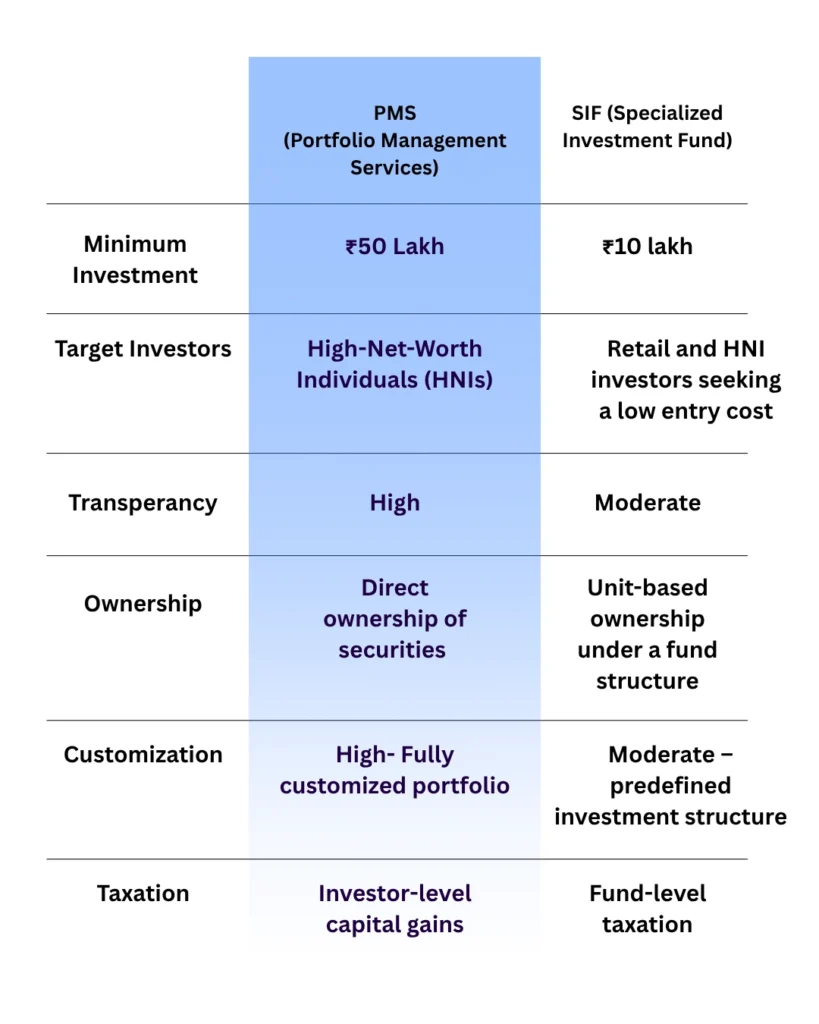

Portfolio Management Services (PMS) and Specialized Investment Funds (SIF) are advanced investment options designed for high-net-worth investors who want personalized attention and active management.

Portfolio Management Services (PMS) is a customized investment service where a professional portfolio manager invests your money in stocks, bonds, and other securities specifically tailored to your goals, risk profile, and time horizon. Unlike mutual funds, PMS offers direct ownership of securities, giving you full transparency and control over your investments.

Minimum Investment: ₹50 lakh (as per SEBI guidelines)

Specialized Investment Fund (SIF) is a new category of investment introduced by SEBI from April 1, 2025. It allows Asset Management Companies (AMCs) to create customised, strategy-based portfolios that offer investors greater flexibility and diversification than conventional mutual funds. They are designed for investors who prefer advanced asset allocation strategies within a structured and regulated framework.

Minimum Investment: ₹10 lakh (as per SEBI guidelines)

PMS begins with a detailed understanding of your financial goals, investment horizon, and risk profile. Based on this, a dedicated portfolio manager designs a customised investment strategy—carefully selecting stocks, bonds, and other assets aligned with your objectives.

Your portfolio is actively managed by professionals who monitor market movements, rebalance investments when needed, and keep you updated on performance. You enjoy direct ownership of the securities in your demat account, ensuring complete transparency and control.

SIFs pool money from multiple investors to invest in strategy-based portfolios focused on specific themes or asset classes. Each scheme is professionally managed by experienced fund managers who make allocation decisions within SEBI’s regulated framework.

Investors participate as unit holders and receive periodic updates on their fund’s performance and portfolio composition. SIFs provide access to advanced investment strategies and diversification at a lower entry threshold than PMS, while maintaining SEBI’s standards of transparency and investor protection.

These funds are less volatile and generally safer compared to equity funds, making them a great choice for conservative investors.

Personalized Portfolio

Both PMS and SIFs focus on tailoring investment strategies to match investors’ financial goals and risk appetite. PMS provides individually managed portfolios for each investor, while SIFs offer professionally curated, strategy-based schemes catering to groups of investors with similar objectives.

Professional Management

In both PMS and SIFs, experienced fund managers actively construct portfolios, select assets, and adjust strategies to enhance returns and control risk.

Regulatory Oversight

Governed by SEBI, both PMS and SIFs follow strict compliance frameworks designed to uphold transparency, safety, and investor confidence.

Diversification

Investors can gain exposure to multiple asset classes such as equities, bonds, REITs, commodities, and alternatives. PMS offers tailored diversification, whereas SIFs provide flexible and strategy-based portfolios.

Potential for Higher Returns

With personalized strategies and active management, both PMS and SIF aim for superior long-term wealth creation compared to traditional instruments.

For investors seeking advanced, professionally managed investment options, PMS and SIFs offer tailored strategies designed around your goals and risk appetite. Here are the types you can choose from:

Portfolio Management Services (PMS) are categorised based on the level of control and involvement between the investor and the portfolio manager:

The portfolio manager takes full responsibility for managing your investments, making all buy and sell decisions based on your financial goals and risk profile. The control and execution remain entirely with the fund manager.

The portfolio manager provides expert recommendations, while you make the final investment decisions. Every trade is executed only after your approval, ensuring complete control over your portfolio.

The portfolio manager acts as a consultant, offering insights and research-based advice. You retain full authority to make and execute all investment decisions.

Specialized Investment Funds (SIFs) are classified into three main categories based on their investment focus and strategy:

Include Equity Long Short, Equity Ex Top 100 Long Short, and Sector Rotation Long Short strategies, designed to capture opportunities in equity markets through selective long and short positions.

Include Debt Long Short and Sectoral Debt Long Short strategies, focused on generating stable returns from bonds while tactically managing interest rate and sector exposures.

Include Active Asset Allocator Long Short and Hybrid Long Short strategies, offering diversified exposure across equity, debt, and alternative assets with flexible allocation for balanced growth.

For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreImagine you have ₹1 crore to invest. Your wealth advisor tells you: “Put it in a mutual fund for safe, diversified growth.” “Try a PMS for a customized strategy.” “Or,...

Read MoreDespite having your portfolio spread across real estate, fixed deposits, mutual funds, or stock market tips, do you still feel your investments aren’t really working for you? You’re not alone....

Read MoreMarkets move, so do we.

Bringing you the fastest dose of financial news, market updates, and one-of-a-kind tools, so you have the first mover advantage, the Ashvvy Advantage.

3000+ people are growing their wealth with us, are you next?

3000+ people are growing their wealth with us, are you next?

ABOUT US

HELP

AMFI Registered Mutual Fund Distributor | ARN- 172057 | Initial Date of Registration: 28/8/2020 | Current Validity: 27/8/2026

Grievance Officer: Rishika Jain | 9643879317

Copyright © 2025 Ashvvy Investment. All rights reserved.