For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreAshvvy makes it simple for NRIs to grow wealth in India without stress or uncertainty.

Being an NRI means living in two financial worlds at once.

Your goals and challenges are very different from someone based in India, and investing back home often has an emotional side too: staying connected, supporting parents, giving back.

But turning that intention into action isn’t simple. Here’s why:

ASHVVY provides a dedicated financial planning solution that operates at the intersection of international law and Indian finance. We simplify the complexity, so you can focus on your career and family.

NRE/NRO/PIS rules can feel overwhelming. We take care of all paperwork and regulatory steps, so everything stays FEMA- and RBI-compliant.

We incorporate currency-aware investment products to protect your returns against adverse rupee fluctuations, preserving the value of your foreign earnings.

Every NRI story is different, so you get a personalized guidance from our NRI expert, Rishika Jain. She helps simplify decisions and remove the stress of navigating complex NRI rules alone.

Most NRIs unknowingly pay more tax than required. We structure income from rent, interest, and capital gains using DTAA benefits so you keep more of what you earn, instead of losing it to double taxation.

Rishika Jain is a legal and financial professional specialising in NRI wealth management and cross-border investment strategies. She holds a B.A. LL.B (Hons.) degree, which gives her a strong foundation in financial law, taxation, and regulatory compliance—an essential edge when navigating India’s evolving investment landscape for global investors.

She is also a Certified Financial Planner (CFP), bringing a globally recognised standard of expertise in financial planning, risk management, estate structuring, and goal-based portfolio design.

With 5+ years of experience in the financial services industry, Rishika has built and managed sophisticated NRI portfolios across Europe, Singapore, Dubai, and Australia. Her advisory approach blends legal precision with practical investment insight, ensuring NRIs receive compliant, tax-efficient, and high-growth strategies tailored to their country of residence and long-term goals.

Rishika specialises in:

– NRI taxation & FEMA compliance

– Cross-border investment structuring

– Mutual funds, AIFs, PMS & fixed-income strategies for NRIs

– Repatriation planning & global income alignment

– Succession planning for international families

Passionate about simplifying finance, she is dedicated to helping NRIs build wealth in India with clarity, confidence, and complete transparency.

For many investors, diversification means holding a few mutual funds across equity, debt, or gold. For high net-worth investors (HNIs), it goes deeper. True diversification is about combining different strategies...

Read MoreImagine you have ₹1 crore to invest. Your wealth advisor tells you: “Put it in a mutual fund for safe, diversified growth.” “Try a PMS for a customized strategy.” “Or,...

Read MoreSIP or Systematic Investment plans have caught up as a household name. Most people today choose a digital platform of choice and invest in monthly SIPs. While there is nothing...

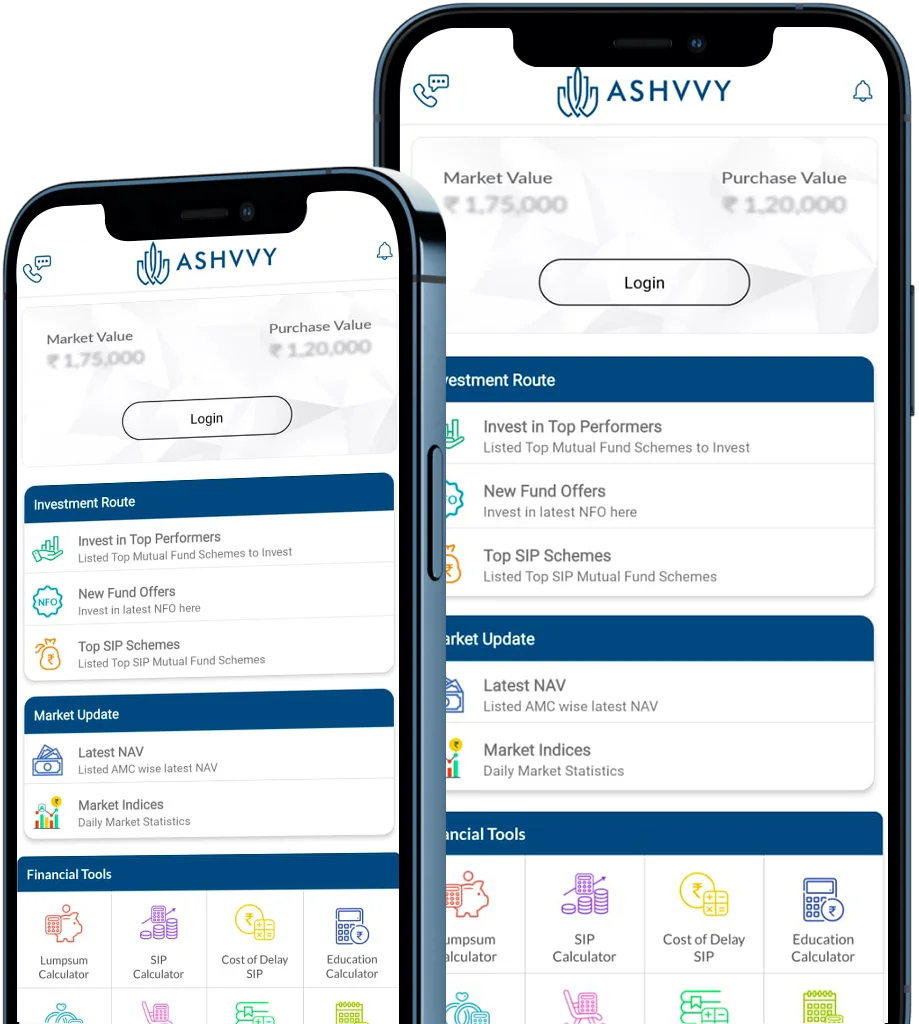

Read MoreMarkets move, so do we.

Bringing you the fastest dose of financial news, market updates, and one-of-a-kind tools, so you have the first mover advantage, the Ashvvy Advantage.

3000+ people are growing their wealth with us, are you next?

3000+ people are growing their wealth with us, are you next?

ABOUT US

HELP

AMFI Registered Mutual Fund Distributor | ARN- 172057 | Initial Date of Registration: 28/8/2020 | Current Validity: 27/8/2026

Grievance Officer: Rishika Jain | 9643879317

Copyright © 2025 Ashvvy Investment. All rights reserved.