Imagine you have ₹1 crore to invest.

Your wealth advisor tells you:

“Put it in a mutual fund for safe, diversified growth.”

“Try a PMS for a customized strategy.”

“Or, if you’re adventurous, an AIF could get you private equity-like returns.”

You pause and think between these three choices. Which path leads to higher returns?

This is the exact dilemma many Indian investors face as their portfolios grow. To answer this, let’s dive deep into Mutual Funds vs. PMS vs. AIF, their differences, pros and cons, real-world implications, and, most importantly, which one could be right for you.

What are Mutual Funds (MF)?

In simple terms, a mutual fund is a pool of money collected from retail investors, invested in stocks, bonds, or hybrids, and managed by SEBI-registered fund houses. Mutual funds are mainly suitable for those who want convenience, liquidity, and diversification.

There is a wide range of options available within mutual funds. Investors can choose from equity funds for long-term wealth creation, debt funds for stability, hybrid funds for a balance of growth and security, and even index funds for low-cost market participation. This wide spectrum ensures that whether someone is a risk-averse saver or an ambitious growth seeker, there is a mutual fund category that aligns with their financial goals.

What are Portfolio Management Services (PMS)?

Portfolio Management Services (PMS) offer a personalized and sophisticated approach to wealth creation, designed for High Net Worth Individuals (HNIs). Unlike mutual funds, where investors hold units of a pooled portfolio, PMS investors directly own securities in their demat and bank accounts. This structure provides greater transparency, control, and engagement with the portfolio manager.

PMS can be discretionary (manager makes decisions) or non-discretionary (advisory-based). With concentrated portfolios and high customization, PMS strategies align closely with individual goals and risk profiles. SEBI mandates a minimum investment of ₹50 lakh, making PMS exclusive, with relatively higher fees than mutual funds.

There is a wide range of options available within mutual funds. Investors can choose from equity funds for long-term wealth creation, debt funds for stability, hybrid funds for a balance of growth and security, and even index funds for low-cost market participation. This wide spectrum ensures that whether someone is a risk-averse saver or an ambitious growth seeker, there is a mutual fund category that aligns with their financial goals.

What are Alternative Investment Funds (AIFs)?

Alternative Investment Funds, or AIFs, represent the most sophisticated layer of investment options in India. These are privately pooled investment vehicles that channel money into non-traditional assets, ranging from venture capital and private equity to real estate projects, hedge funds, and structured debt. The entry barrier is high because SEBI requires a minimum investment of ₹1 crore, which makes AIFs accessible only to Ultra-HNIs and institutions.

Unlike mutual funds and PMS, which focus on listed stocks and bonds, AIFs often operate in spaces that are beyond the reach of retail investors. For instance, an AIF might invest in a promising pre-IPO startup, acquire distressed companies for turnaround opportunities, or participate in specialized credit structures.

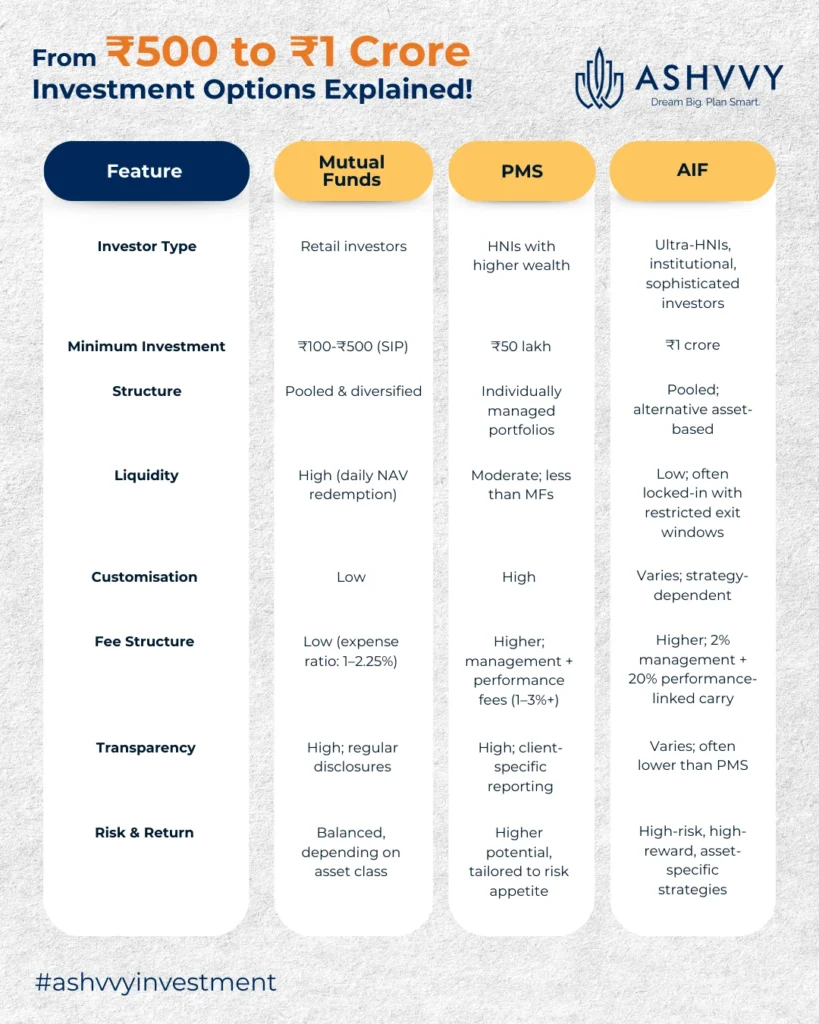

Key Features of Mutual Funds, PMS and AIF

Minimum Investment -

- Mutual Funds: Entry starts as low as ₹100 in SIPs or around ₹5,000 in a lump sum, making them highly accessible.

- PMS: SEBI mandates a minimum ticket size of ₹50 lakh, which limits PMS to HNIs.

- AIF: SEBI mandates a minimum ticket size of ₹1 crore, making it accessible only to Ultra-HNIs and institutions.

Underlying securities –

1. Depending on the fund type, mutual funds invest in:

- Stocks (large-cap, mid-cap, small-cap, sectoral, thematic).

- Debt instruments (government securities, corporate bonds, etc.).

- Hybrid funds (a mix of equity and debt for balanced risk).

- Index funds/ETFs (replicating stock market indices).

2. PMS portfolios can include listed equities, debt instruments, ETFs, structured products, and cash equivalents, tailored to the investor’s needs.

3. AIFs invest in:

- Category I – Startups, SMEs, infrastructure, and socially beneficial projects.

- Category II – Private equity, debt funds, distressed assets, and special situation funds.

- Category III – Hedge funds, derivatives, and complex trading strategies.

Liquidity –

- Mutual funds: Easy redemption at the prevailing NAV, usually credited within 1-3 working days.

- PMS: Not as flexible as mutual funds. Redemption can take longer depending on how quickly the underlying securities can be liquidated.

- AIF: Typically low. Many AIFs come with lock-in periods of 5–7 years, making them illiquid compared to MFs and PMS.

Risk Factors –

- Mutual Funds: Returns are market-linked and subject to risks like equity market volatility, interest rate changes in debt funds, and potential changes in fund management.

- PMS: Strategies are often concentrated, unlike mutual funds, which means higher potential returns but also greater risk from market volatility and manager calls.

- AIF: Higher risk compared to traditional investments. Risks include illiquidity, valuation risk in private markets, leverage risk (in Cat III), and business failure risk (in startups/PE).

Taxation –

- Equity mutual funds are taxed at 12.5% LTCG on gains above ₹1.25 lakh (if held >1 year). Short-term capital gains (STCG) on units held for less than a year are taxed at 20%.

- In PMS, since securities are held directly, capital gains are taxed in the investor’s hands (as equity or debt, depending on the asset class).

- For AIF, tax treatment depends on the category. Categories I & II are pass-through (income taxed in the hands of investors), while Category III is taxed at the fund level.

Transparency & Regulation –

- Mutual Funds: Strict SEBI regulation, daily NAV, monthly factsheets, and quarterly portfolio disclosures ensure high transparency.

- PMS: SEBI-regulated, with quarterly disclosures and direct client reporting, offering personalized but less frequent transparency.

- AIF: Governed by SEBI (AIF Regulations, 2012) with limited, periodic reporting, making them less transparent than MFs and PMS.

Suitability –

- Mutual Funds are suitable for retail investors, beginners and long-term wealth builders who want professional management, diversification and affordability.

- PMS caters to High Net Worth Individuals (HNIs) seeking a personalized, transparent, and actively managed investment strategy.

- AIFs are for Ultra HNIs, family offices, and institutional investors looking for diversification beyond traditional markets, with a tolerance for high risk and lower liquidity.

Mutual Funds vs PMS vs AIF Comparison

Which Is Better: Mutual Funds, PMS or AIF?

There’s no one-size-fits-all answer. It depends on who you are as an investor:

If you are just starting out, go with mutual funds. SIPs are the easiest way to build long-term wealth.

If you are an HNI (₹50 lakh+ of investable capital), PMS makes sense if you want control, customization, and can handle concentrated risks.

Suppose you are an Ultra-HNI (₹1 crore or more available for investment). In that case, AIFs can help diversify into private equity, real estate, and other high-growth areas.

Many savvy investors combine all three:

- Mutual funds for stability.

- PMS for customized strategies.

- AIFs for aggressive bets.

If you’re still unsure which option aligns with your goals, reach out to Ashvvy Investments. Our experts guide you in selecting between mutual funds, PMS, and AIFs based on your individual objectives and risk profile.

Conclusion

When we look at the difference between mutual funds, PMS, and AIF, it becomes clear that each caters to a distinct class of investors. Mutual funds are the most accessible, offering diversification and liquidity for small investors. PMS suits HNIs seeking personalized portfolios aligned with their goals, while AIFs cater to ultra-HNIs and institutions exploring complex strategies like private equity or hedge funds. The right choice depends not only on investment size and risk appetite but also on financial objectives, time horizon, and the fund manager’s expertise, philosophy, and costs.