February 2026 sees another round of mutual fund launches, with AMCs rolling out schemes across equity, sector-focused themes, and passive investing options. As markets remain selective and investors become more theme-aware, these New Fund Offers reflect where fund houses see long-term opportunities building up.

If you’re evaluating new ideas for your portfolio or tracking upcoming launches before taking a call, understanding what these NFOs aim to offer is a good place to start. Below is a snapshot of the key upcoming and ongoing mutual fund NFOs in February 2026.

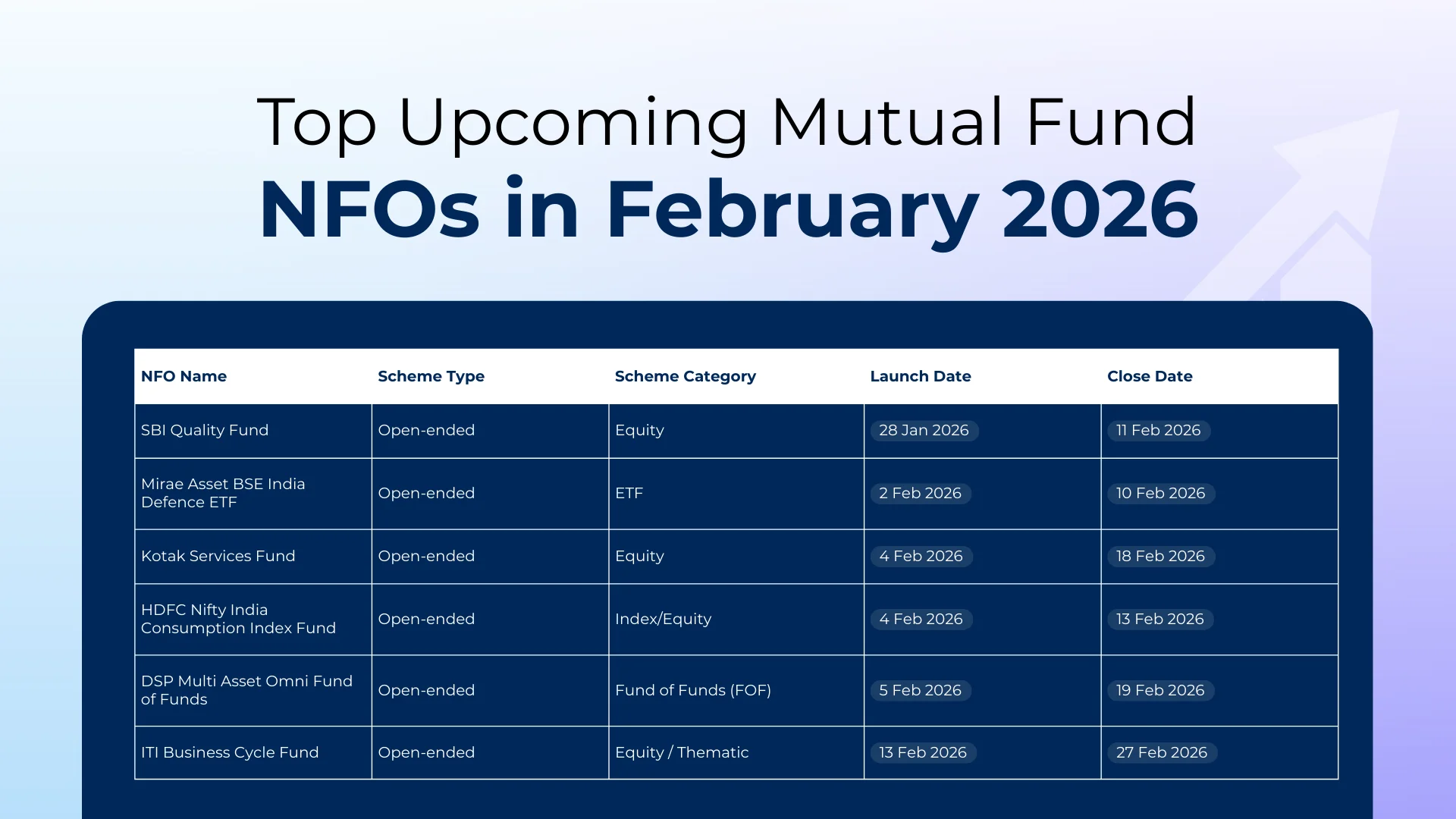

Key Upcoming NFOs in February 2026

Here are some of the notable NFOs launching this month:

NFO Name | Scheme Type | Scheme Category | Launch Date | Close Date |

SBI Quality Fund | Open-ended | Equity | 28 Jan 2026 | 11 Feb 2026 |

Mirae Asset BSE India Defence ETF | Open-ended | ETF | 02 Feb 2026 | 10 Feb 2026 |

Kotak Services Fund | Open-ended | Equity | 04 Feb 2026 | 18 Feb 2026 |

HDFC Nifty India Consumption Index Fund | Open-ended | Index/Equity | 04 Feb 2026 | 13 Feb 2026 |

DSP Multi Asset Omni Fund of Funds | Open-ended | Fund of Funds (FOF) | 05 Feb 2026 | 19 Feb 2026 |

ITI Business Cycle Fund | Open-ended | Equity / Thematic | 13 Feb 2026 | 27 Feb 2026 |

1. SBI Quality Fund

The SBI Quality Fund is an open-ended equity scheme that invests in equity and equity-related instruments selected using the Quality Factor. The fund focuses on companies with strong balance sheets, stable earnings, efficient capital use, and sound management practices. Rather than following short-term market trends, it aims to build a portfolio of businesses that can perform consistently across market cycles.

Suitable for: Investors looking for long-term equity exposure through financially strong companies.

2. Mirae Asset BSE India Defence ETF

The Mirae Asset BSE India Defence ETF is an open-ended ETF that tracks the BSE India Defence Index. It invests in defence-related companies in the same proportion as the index, offering a passive way to gain exposure to India’s defence manufacturing and related businesses. The fund covers both core defence companies and supporting players that benefit from government spending and domestic production initiatives.

Suitable for: Investors who want focused exposure to the defence sector through a passive fund.

3. Kotak Services Fund

The Kotak Services Fund invests in companies from India’s services-driven sectors such as financial services, IT, telecom, healthcare, and consumer services. These sectors form a large part of India’s economic activity and employment generation. This fund can appeal to investors looking to benefit from the steady expansion of India’s service economy. Since it is sector-focused, it works better as a portfolio add-on rather than a standalone core holding.

Suitable for: Investors looking to add services-sector exposure to their equity portfolio.

4. HDFC Nifty India Consumption Index Fund

This fund is a passive index fund that tracks the Nifty India Consumption Index. It invests in companies that benefit directly from household spending, including FMCG, automobiles, retail, and consumer durables. The fund holds the same companies as the index and adjusts its portfolio whenever the index changes. It offers a simple way to invest in consumption-driven businesses without stock selection.

Suitable for: Investors who want to invest in consumption-driven companies using a passive approach.

5. DSP Multi Asset Omni Fund of Funds

This fund invests across different asset classes through underlying mutual funds. Its portfolio may include equity, debt, and commodity-linked funds such as gold or silver ETFs. This structure helps spread risk across assets instead of depending on one investment type. It offers diversification through a single fund, making portfolio management easier.

Suitable for: Investors seeking diversification across equity, debt, and commodities in one fund.

6. ITI Business Cycle Fund

It is an open-ended equity fund that invests across sectors based on how the economy is performing at different stages of the business cycle. Instead of sticking to one theme or sector, the fund shifts its focus as the economy moves through phases like recovery, growth, slowdown, or correction. The idea is to increase exposure to sectors that may benefit most in each phase while reducing exposure where growth may slow.

Suitable for: Investors with a long-term horizon who are comfortable with periodic changes in the portfolio.

Final Thoughts

February 2026 NFOs offer a mix of equity, sector-focused, passive, and multi-asset funds. While new launches can be interesting, they should be chosen based on portfolio fit, risk comfort, and long-term goals. You can read our detailed guide here: How to invest in Mutual Funds in India?

At Ashvvy Investments, we guide you through upcoming NFOs by helping you assess suitability, understand portfolio relevance, and invest in line with your long-term financial goals.