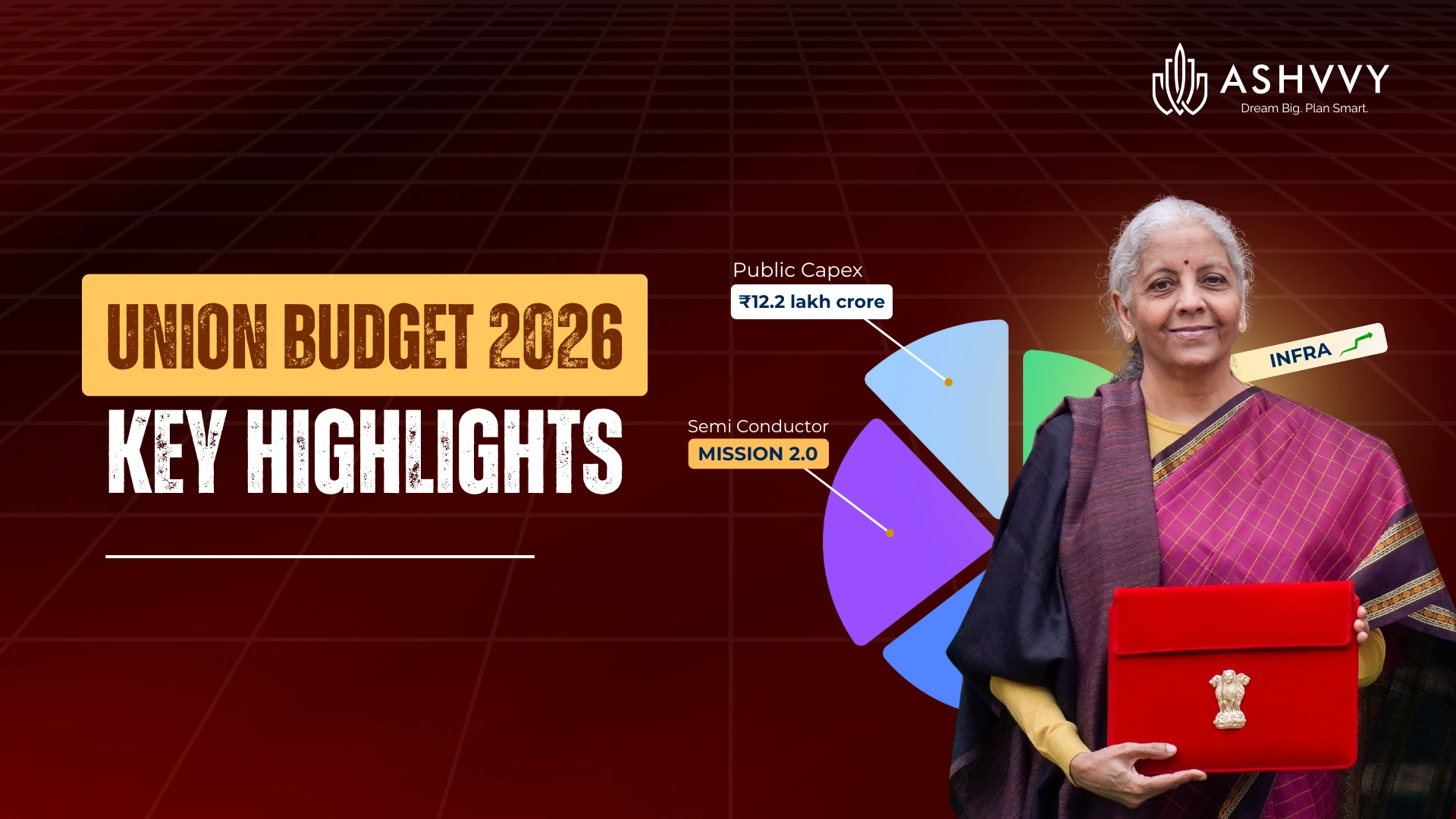

Finance Minister Nirmala Sitharaman presented the Union Budget 2026–27 in Parliament on 1 February 2026. This was her ninth consecutive budget, setting the economic direction for the coming year. This budget focuses on maintaining growth momentum, strengthening manufacturing and infrastructure, using technology to support agriculture, and expanding social spending, while keeping fiscal discipline in mind. Let’s take a look at the key highlights of the budget 2026.

1. Three Guiding “Kartavyas” of Budget 2026

The Union Budget 2026 is built around three broad guiding responsibilities that define the government’s economic and social priorities:

- Keep economic growth strong and resilient

- Strengthen households and support people’s aspirations

- Drive inclusive progress across regions, communities, and sectors

Together, these principles underline the government’s intent to pursue growth that is resilient, people-centric, and broadly shared.

2. Economic Overview

A. Higher spending on infrastructure

The government has raised public capital spending for FY27 to ₹12.2 lakh crore from ₹11.2 lakh crore, showing its focus on investment-led growth. Infrastructure spending is expected to continue supporting jobs and economic activity.

B. Fiscal discipline remains on track

The government has committed to reducing the fiscal deficit to 4.3% of GDP in 2026–27, from 4.4% in 2025–26, indicating a steady move toward fiscal discipline without hurting growth.

C. Debt levels gradually improving

For 2026–27, the government aims to bring the debt-to-GDP ratio down to 55.6%, from 56.1% this year, showing a gradual strengthening of India’s fiscal position.

3. Income Tax Reforms

The income tax rates under the new regime remain unchanged from last year. The existing tax slabs continue as follows:

Tax rates under the new regime:

Up to ₹4 lakh – No tax

₹4 lakh to ₹8 lakh – 5%

₹8 lakh to ₹12 lakh – 10%

₹12 lakh to ₹16 lakh – 15%

₹16 lakh to ₹20 lakh – 20%

₹20 lakh to ₹24 lakh – 25%

Above ₹24 lakh – 30%

– Extended filing timeline: The deadline for filing revised income tax returns is now March 31 (previously December 31), on payment of a small fee.

– Reduced TCS rates:

On overseas tour packages – 2% (down from 2-20%)

On LRS remittances for education and medical purposes – 2% (down from 5%)

These changes aim to simplify compliance, reduce the burden on taxpayers, and make overseas remittances and travel-related payments easier.

4. Sectoral Highlights

A. Manufacturing

– India Semiconductor Mission 2.0 and other schemes to boost chip and electronics production.

– ₹10,000 crore SME Growth Fund to support small and medium industries.

– Incentives for biopharma, textiles, and rare-earth processing.

B. Agriculture

– Bharat Vistaar platform for AI-based advice to farmers.

– Support for fisheries, horticulture, and high-value crops to improve incomes.

C. Infrastructure

– Public capital spending raised to ₹12.2 lakh crore for FY27.

– New high-speed rail corridors, freight corridors, and waterways projects.

D. Energy & Renewables

– Focus on green energy, battery storage, nuclear and gas projects.

– Total energy allocation is around ₹1.09 lakh crore.

E. Sports

– Khelo India programme expanded for talent development.

– Support for sports infrastructure and skill training.

F. Health

– Expansion of medical tourism hubs and training for healthcare workers.

– Support for biopharma and critical drugs.

G. Defence

– Budget allocation ₹7.85 lakh crore, with ₹2.19 lakh crore for modernisation.

– Focus on advanced equipment and domestic production.

H. Real Estate

– Focus on reviving demand in affordable and mid-income housing.

– Interest deduction on home loans for self-occupied properties continues; under the old regime, up to ₹2 lakh per year.

I. Education

– ₹1.39 lakh crore allocated to education, the highest ever for the sector.

– New creator labs in 15,000 schools and 500 colleges to build digital and creative skills.

J. Banking & Financial Services

– A High‑Level Committee on Banking for Viksit Bharat was announced to strengthen banking reforms, improve financial inclusion, and protect consumers.

– Measures to deepen corporate bond markets, municipal bonds, and foreign investment norms aim to boost capital market depth.

Conclusion

The Union Budget 2026 aims to keep India’s economy growing while maintaining fiscal discipline. It focuses on improving lives, supporting businesses, and creating opportunities for households, entrepreneurs, and investors alike. Overall, it sets a clear path for steady, inclusive, and people-centric growth in the year ahead.